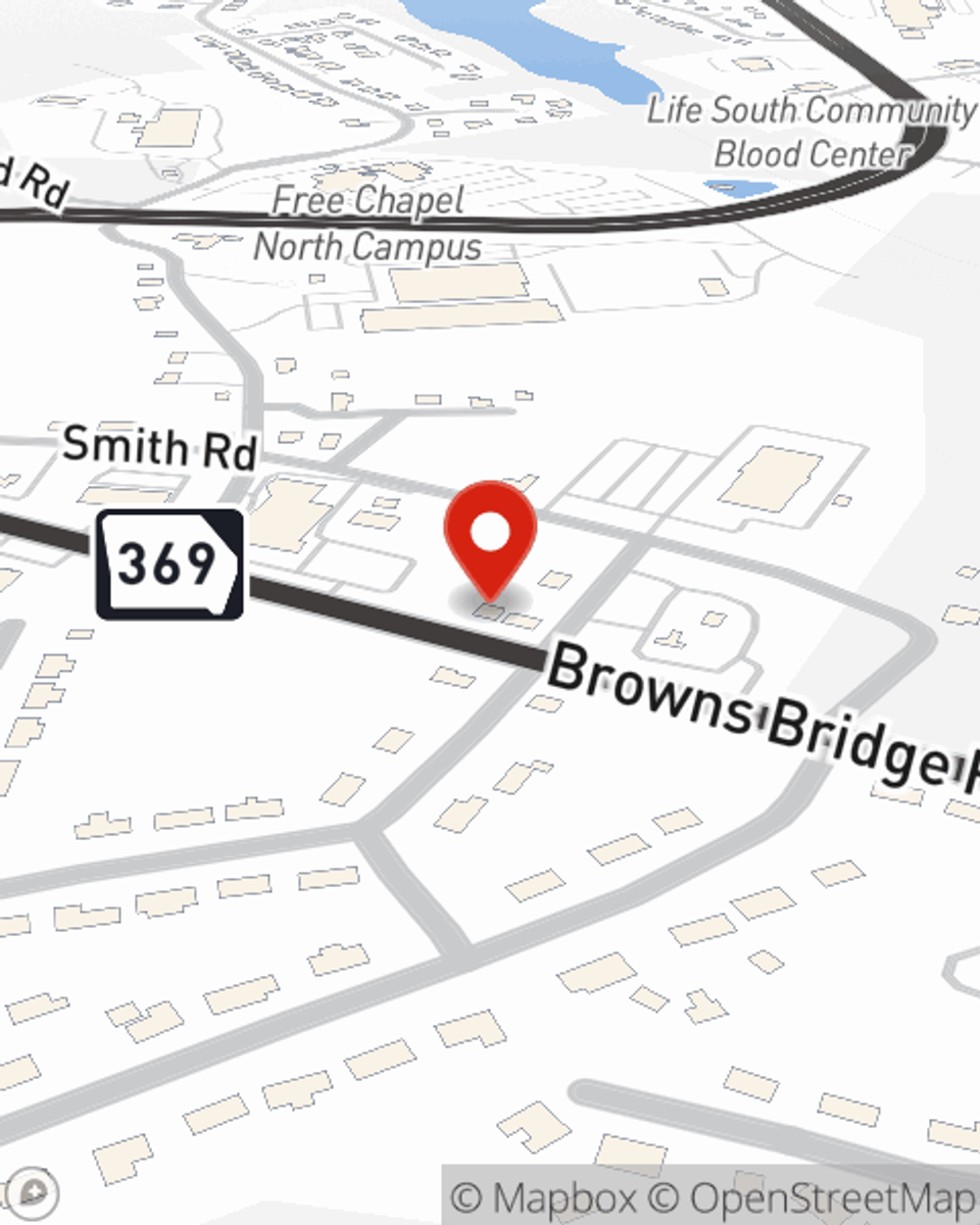

Insurance in and around Gainesville

Bundle policies and save serious dollars

Customizable coverage based on your needs

Would you like to create a personalized quote?

- Lula

- Flowery Branch

- Oakwood

- Braselton

- Hoschton

- Buford

- Dacula

- Sugar Hill

- Talmo

- Jefferson

- Winder

- Athens

- Statham

- Dawsonville

- Suwanee

- Cumming

Find The Insurance Coverages You Need At State Farm.

Help protect what's important to you - your loved ones, vehicle, etc. - with the great insurance that State Farm offers. Agent Sheila Sanchez can help you set-up a Personalized Price Plan® that's right for you. And don't forget to ask about the safe driving rewards, bundling options and discounts!

Bundle policies and save serious dollars

Customizable coverage based on your needs

We’re There When You Need Us Most

Some of these great options include Renters, Health, Boat and Pet insurance. Not only is State Farm insurance a great value, but it's a smart choice.

Simple Insights®

What can 529 funds be used for if my child doesn't go to college?

What can 529 funds be used for if my child doesn't go to college?

Wondering about 529 plan rules and what happens to unused 529 plan funds? They can be used in other ways. We break down the options.

How much car insurance do I need?

How much car insurance do I need?

Learn about coverages, deductibles, limits, liability and more to help decide how much auto insurance you need and how you can save.

Sheila Sanchez

State Farm® Insurance AgentSimple Insights®

What can 529 funds be used for if my child doesn't go to college?

What can 529 funds be used for if my child doesn't go to college?

Wondering about 529 plan rules and what happens to unused 529 plan funds? They can be used in other ways. We break down the options.

How much car insurance do I need?

How much car insurance do I need?

Learn about coverages, deductibles, limits, liability and more to help decide how much auto insurance you need and how you can save.